Neobank app Tonik launched on March 18 as the Philippines' first digital-only bank in hopes of bringing financial services to Filipinos amidst the pandemic where contactless and cashless transactions reign.

Here's everything you need to know about Tonik Bank:

What is a "Neobank?"

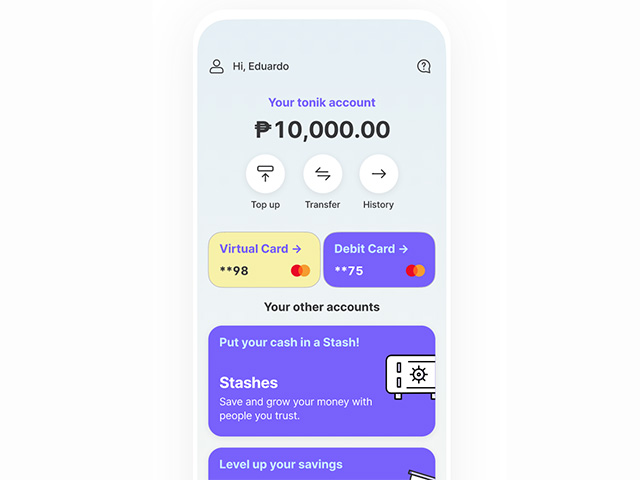

Tonik is a 100% digital bank-from sign-up to payment approvals. In short, everything can be done on your phone. Top-ups and cash-ins are at your fingertips, and the company believes these digital transactions will be the new normal for Filipinos.

Neobanks, unlike traditional banks, offer Internet-only services, which means Tonik doesn't have physical branches. Tech-savvy individuals may find this appealing, especially if they want to skip long queues at the bank and don't mind full money management in-app. The all-online aspect of neobanks permits users to transact anytime, effectively eliminating the risk of going to a physical bank and being exposed to the virus.

You might think this is sketchy since it breaks away from everything a traditonal bank is, but Tonik is regulated by the Bangko Sentral ng Pilipinas. They're also signed on with BancNet and MasterCard.

Is the Philippines ready for it?

According to Tonik Philippines president Long Pineda, only around 30% of Filipinos have a bank account. That means seven out of 10 Filipinos remain in the dark when it comes to banking, and it makes sense—traditional banking is intimidating with all the forms and required IDs, and money errands can take up to a full day.

With more consumers turning to virtual shopping and deliveries to access their essentials without the risk of catching the virus by going out, online services—banking included—saw a boom during the pandemic.

A total of 98.5% of Filipino adults are connected online, and Tonik saw this as a potential to reach unbanked individuals by making banking friendlier and more accessible, from the interface down to the informal, chummy language it uses.

This also echoes the Bangko Sentral ng Pilipinas' (BSP) aspiration in advancing financial inclusion, with their goal of converting at least 70% of Filipino adults to the formal financial system by 2023.

"This is a first in the history of banking... This shift towards digital channels unlock the greater opportunities to benefit from the digital banking platforms with efficiency and value-added propositions," said Chuchi Fonacier, BSP's deputy governor of the financial supervision sector.

Signing Up for Tonik

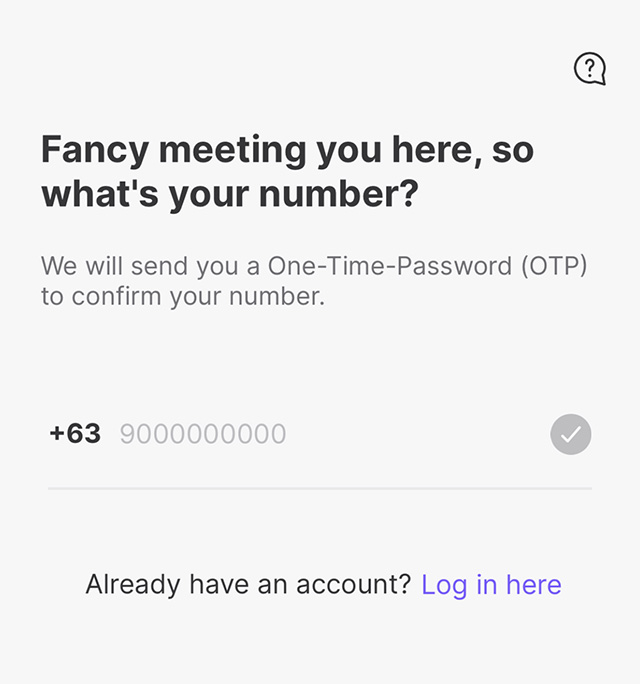

The Tonik app is available to download for free for both iOS and Android. You'll need a working cell phone number so the app can send you one-time pins before transactions push through.

Basic details such as your name, birthday, and address are required. It will also take a photo, while providing a digital copy of a valid ID is optional. Do take note that choosing to skip the ID proof limits the number of features you can use. Providing proof of identity and confirming your e-mail unlocks more services for your account. New accounts are given a P50,000 credit limit.

Howto Use Tonik

After signing up, you'll be given a virtual credit card you can use for online purchases or bills payment. Be sure to top it up with load, which can be done over the counter through 7-Eleven or via digital payment services like GCash.

Cashing in via your bank account and QR code transfers will come in the following months, while check deposits via photos might be a possible feature in the future. Locking the virtual credit card is an added security blanket to protect your funds as you use it online.

Saving up for something? The app comes with a "Stash" feature that lets you save for specific needs such as tuition, travel, and more. You can also work with friends or family on a group Stash to reach a savings goal faster—a useful function for businesses or future travel getaways. Each account can have up to five active stashes.

According to chief product officer Ed Joson, Stashes with Tonik have an interest rate of 4 to 4.45% per annum, while time deposit accounts have an interest rate of 6%.

Taking your money out from Tonik can be done in multiple ways: Cashing out via GCash is possible without any fees, but if you prefer cashing out over the counter, you can do so via Cebuana or MLhuillier. Transferring your Tonik savings to your other bank accounts is possible as long it honors InstaPay.

For more information, log on to Tonik's website.

Hey, Spotters! Check us out on Viber to join our Community and subscribe to our Chatbot.

Source: Spot PH

No comments:

Post a Comment