(SPOT.ph) Remember when physically lining up at a cashier to pay for things was the norm? With the rise of virtual wallets, "add to cart" has become every online shopper's new motto. So in case you're still getting the hang of making cashless payments—"Cash you can't see? What's that about?" said a parent somewhere, probably—we lay down everything you need to know in this guide! From how to use the most popular cashless payment options to last resorts when dealing with customer service, we got you covered.

Also read:

Reality Check: How to Streamline Your Spending Without Going Into a Panic

10 Online Services to Try for a Cashless Existence

SPOT.ph Roadtest: Which Mobile Banking App Is the Handiest?

Here's how you can get on the most popular virtual wallets out there:

[BigImage:{"illustrator":"War Espejo","image":"https://images.summitmedia-digital.com/spotph/images/2020/10/22/virtual-wallets-breaker-1-1603371784.jpg"}]

There are several popular platforms out there today. Some function mainly as a way to pay for services online while others have an entire extended universe a la Marvel worth of features—but more on which one to get based on what you need later. We discuss what you need when opening an account with some of the most popular digital wallets out there.

GCash

[youtube:{"videoId":"null","youtubeId":"-ZHUjd5p-rI", "caption":""}]

Do you need a bank account? Nope—but you can link it!

Do you need to download the app to register? You can register through their site but the app is where all the transactions can be made.

You can register to Globe's mobile wallet either on your browser or on the app with your mobile number; no need to have a Globe number either. Once you've entered your mobile number and other information, you will be asked to create an MPIN. This will act as your passcode whenever you use GCash so be sure not to forget it! Verifying your account will give you full access to the platform's services—and add another layer of security—and will entail a valid government ID, your address, and a selfie. While the option to make an account is available on the official site, you will have to download the app to use it.

PayMaya

[youtube:{"videoId":"null","youtubeId":"w7y1tF0_mUo", "caption":""}]

Do you need a bank account? Nope, but you can link it.

Do you need to download the app? Yes.

Make an account on the official PayMaya app with your name, mobile number, and e-mail address; your mobile becomes the official account number. Upgrading your account to get access to more features will take steps similar to GCash, too, so prep your ID and a selfie!

GrabPay

[facebook:https://ift.tt/2GhScZB]

Do you need a bank account? Still no. You still have the option to link it though!

Do you need to download the app? Yes, definitely.

The GrabPay wallet is a main feature of the Grab app so you can easily activate it on your mobile. Head to the "Payment" section of the app by tapping on icon at the bottom of your home screen then select the "Activate your GrabPay Wallet" button. To get the basic services, you will be asked to enter the details of a valid government ID and your address; you can also upgrade your wallet by uploading a pic of the ID and having a quick video call with a Grab representative through the app to verify your identity.

PayPal

[youtube:{"videoId":"null","youtubeId":"t2xZK6ifQsM", "caption":""}]

Do you need a bank account? Negative—but you can link your bank account (or credit card) to your PayPal! (Last time for this spiel, we promise).

Do you need to download the app? Not at all.

You can easily sign up for a personal account on PayPal through their website. Just plug in your e-mail and other details including your name, date of birth, address and contact details. You can also use this if you're a merchant—but with extra steps, of course.

Need something to hold on to? Transform your digital wallets into cards in these ways:

[BigImage:{"illustrator":"War Espejo","image":"https://images.summitmedia-digital.com/spotph/images/2020/10/22/virtual-wallets-loadup-1603371784.jpg"}]

While you can "load up" your virtual wallets in many ways—from over-the-counter options to bank transfers or simply linking up your bank accounts or credit and debit cards—there are some instances when a physical card can't be beat. A lot of online payment services have physical cards you can buy too, just in case you need to type in debit card digits for online shopping.

GCash

[facebook:https://ift.tt/3kNgYzO]

GCash subscribers with fully verified accounts can sign up for a GCash Mastercard, which you can use to cash out your balance through BancNet or Mastercard ATMs. You can also swipe it in shops where credit and debit cards are accepted. GCash Mastercard can be purchased for P150 at convenience stores like Ministop, All Day, Lawson, and 7-11; Puregold supermarkets and Robinsons Department Store; and Villarica and Tambunting pawnshops. There’s also the option of ordering it online through their website or app, and having the card delivered for free within Metro Manila.

PayMaya

[instagram:https://ift.tt/35Yyb30]

While PayMaya allows you to make cashless transactions at convenience stores, payment centers, and pawnshops, you can also choose to have a physical card that you can tap on payWave terminals or swipe on POS terminals. You can use this for online and offline purchases or withdrawing money from BancNet ATMs here and abroad without the hassle of annual fees and bank applications. The PayMaya card, either Visa or Mastercard, can be bought through their website or app for P200 with free delivery on bundle orders or through SM Store Business Services, Robinsons Department Store Business Centers, LCC Supermarkets, Gaisano Capital Business Centers, and selected Family Mart branches.

CEB GetGo Prepaid Card

[facebook:https://ift.tt/3oQ76HS]

While waiting for the day when you can use your GetGo points again to book flights, you can just earn more points with the CEB GetGo Prepaid Card. As a Visa card, it lets you shop online and pay for streaming services or e-games purchases. For every 100-peso spend, you automatically get one GetGo point, which is as good as cash when you pay for your Cebu Pacific tickets in the future. You can buy the card for P150 at the nearest Robinsons Department Store, Ministop, selected 7-11 branches, or FamilyMart. You can also load it via Robinsons Bank, GetGo Pay, and UnionBank Online mobile apps; Robinsons Department Store; CLiQQ kiosks at 7-Eleven branches; and TouchPay kiosks at Mercury Drug, Ayala Malls, and Shell, Petron, and Total gas stations.

Yazz Prepaid Visa

[facebook:https://ift.tt/3jOLWXd]

Unlike most bank-affiliated prepaid cards that you have to get at the banks (obviously), Metrobank's Yazz Prepaid Visa is available at The SM Store, National Book Store, Family Mart, Robinsons Department Store, and selected ECPay outlets. It costs P300 and comes with a free P50 load. It is reloadable through the same partner stores, and can be used for cashless purchases, for withdrawing funds, fund transfer, and for tapping through contactless-enabled card terminals. The card is also as good as a savings account with no maintaining balance.

So which cashless payment option is best for you?

[BigImage:{"illustrator":"War Espejo","image":"https://images.summitmedia-digital.com/spotph/images/2020/10/22/virtual-wallets-roadtest-1603371784.jpg"}]

If you’ve yet to try any of these services for yourself, we tried out some of the most popular options out there and ranked them based on usefulness, fees, user-friendliness, and security.

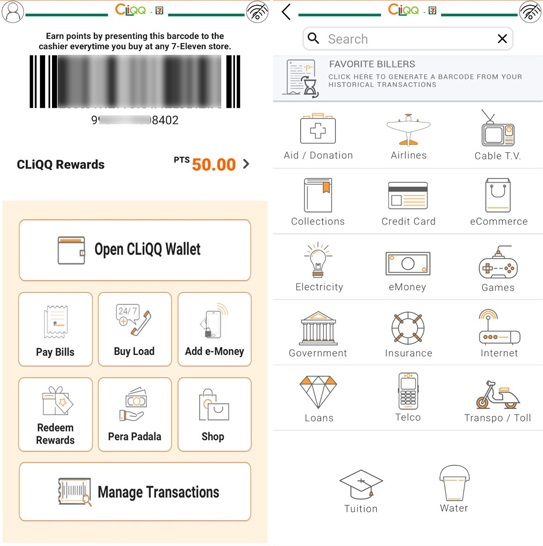

5. CLiQQ

The lowdown: "I first used CLiQQ when I had to pay for airplane tickets at a 7-Eleven, but the CLIQQ kiosk was not working. The cashier suggested I download the app so they could scan the payment barcode from there. Once I registered and got the needed barcode, I had the option of still paying with cash or use the CLiQQ PAY Wallet. In terms of cashless transactions, the CLiQQ payment barcode and virtual wallet are fine—plus you get reward points every time you use it. But, if you want to run errands like paying bills, you will still have to go to the nearest 7- Eleven branch to get your CLiQQ barcode scanned—defeating the purpose of being able to do things virtually." - Christa

The verdict: Going digital is all about mobility, so unless you have a 7- Eleven right next door, this virtual wallet won’t be the handiest one out there. The convenience store’s digital wallet has all the multiple payment portals their in-store kiosks have, and if you choose to pay your bills here, you will still have to go out and pay at the cashier (yes, in a brick-and-mortar shop). You can pay cashless by loading up your CLiQQ account through GCash, PayPal, debit card, or 7- Eleven and earn rewards points through the app! Other than that, this wallet will probably be of most use to those who frequent 7-Eleven a lot.

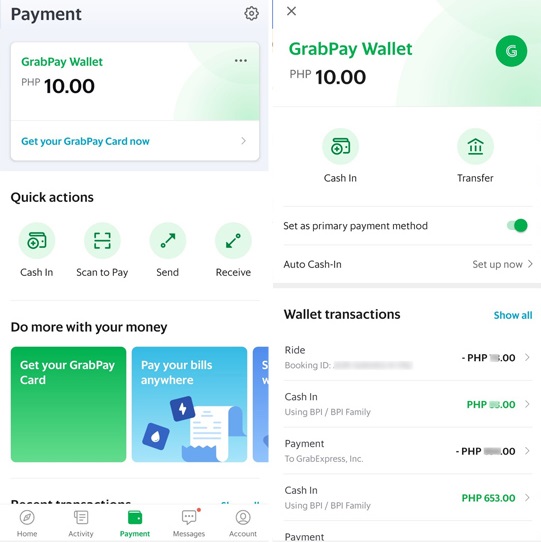

4. GrabPay

The lowdown: "As a regular Grab app user—from their delivery service to their GrabMart feature, especially during quarantine—I have found it very useful to cash in my GrabPay wallet and use that to pay for their services. All I have to do is to select the GrabPay option, instead of cash or credit, after I put in my order or service request. Unlike other virtual wallets, GrabPay allows me to pay only for services within the Grab app. This may sound limiting, but looking at all the services and merchants available, I realize that I pretty much already have everything needed. Plus, I can run all my errands from my phone—from paying the bills to having groceries delivered. GrabPay also lets me earn points, which I can eventually convert to promos and discounts like free delivery." - Christa

The verdict: The GrabPay wallet is integrated with the Grab app, so that would arguably be the main downside. On the brightside, the Grab app has a multitude of built-in services; aside from GrabCar, GrabFood, GrabMart, you can also use it to buy prepaid load, gift cards, and pay for hotel reservations on Agoda or Booking.com, and more. You can also cash in at no charge through SM Business Centers, 7-Eleven, Cebuana Lhuiller, or even through your GrabCar driver. You could also link your debit or credit card through the app. The only time you will be charged a fee is when you load up the GrabPay wallet through mobile banking apps, due to interbank transfers. Overall, the app is especially useful if you often use Grab for your daily tasks.

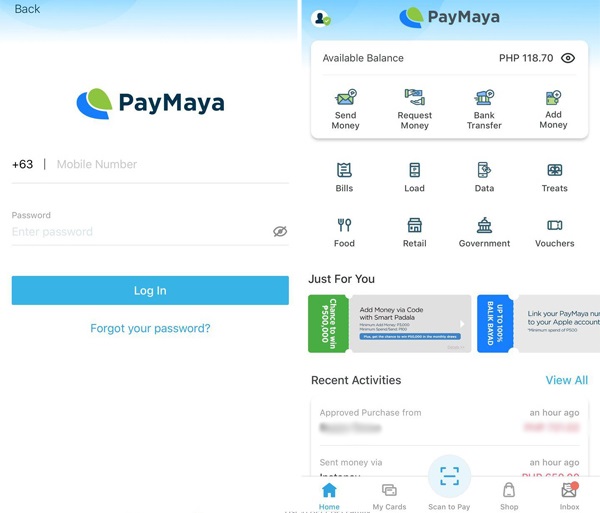

3. PayMaya

The lowdown: "PayMaya is really easy to use. You log in with a password or through touch ID, then select the service of your choice. I use it primarily as a credit card, and so far it’s worked with just about every site I’ve tried (even ones from abroad!). You can also use it to transfer money to other banks, and as of writing there are no fees for doing so. You can cash in through channels like 7-Eleven and even Robinsons Supermarket; there used to be an option to cash in through a debit card but it’s currently disabled for some reason so I just do so through my bank app (using Instapay). You can also easily buy load and pay bills, right from one app.

"My experience with PayMaya has been mostly positive. I do wish their customer service was better though. I don’t think I’ve ever received a response with an actual solution in all the times I’ve emailed their support email, or chatted with their Messenger—I’m just lucky that my all problems so far have magically fixed themselves, but a response would be nice. Another issue is that there are times where I would issue a refund via the website I transacted with and it would take up to three or four days for it to reflect on my PayMaya account. Other than that, PayMaya is super useful." - Trish

The verdict: Probably the main use of a virtual wallet is to be able to complete transactions online—which is exactly what PayMaya does very well. You can use it to pay for utility bills, buy prepaid load, transfer funds to banks (with charges to be added starting November 1), and even pay for stuff from abroad through the product’s site; plus, the app’s easy-to-use design presents all the merchants in an understandable format. In a nutshell, this app will definitely help you get the job done—unfortunately, we can’t say the same for their customer service if you ever do hit a snag.

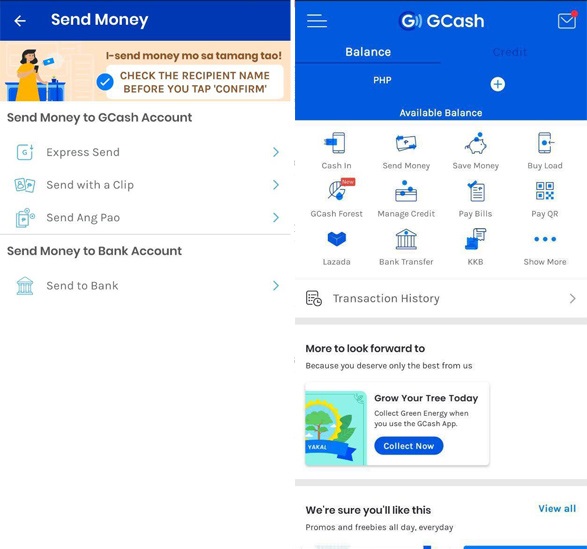

2. GCash

The lowdown: "I use GCash to pay for transactions with small businesses, transfer money to friends and family, as well as pay bills. I like how you can pick a card and add a short message to send to the recipient to go along with the money, and an option to send out a virtual Ang Pao (the money goes back to your wallet if your intended recipient doesn’t claim it in 72 hours).

"GCash has so far been the easiest app I have used to pay bills. After you send money to a GCash user, there's also a download symbol on the top-right part of the screen that lets you save the image file as proof of your payment. It has the name, number, amount, and reference number, which is really handy since most sellers depend on screenshots to verify payment. In terms of security, a one-time-pin is needed for every transaction and for every time you start the app.

"My main gripe with GCash is that I sometimes don’t get to receive text messages as proof of my transactions—and there are times when I don’t get to see my current balance in real-time after having made a transfer. Thankfully, their hotline and the send-a-ticket feature on their site both work. Plus, their agents are extremely helpful!" - Mari

The verdict: GCash has things pat down in terms of the number of things you can do with your virtual wallet. There are a wide variety of services and transactions you can make through GCash, from paying bills, merchants, and even sending money to friends and family. And while the P15 fee for fund transfers to banks on November 1 has everyone abuzz, transfers between GCash accounts will remain free. Perhaps the only thing you have to worry about would be the app’s consistency when updating your account balance and history—especially since this is hard-earned money we’re talking about.

There’s also the many features of the app; all the added options could either make or break your experience. GCash is arguably most useful if your goal with a virtual wallet is to pay for small business transactions and quickly transfer money to other GCash accounts, which has become rather common.

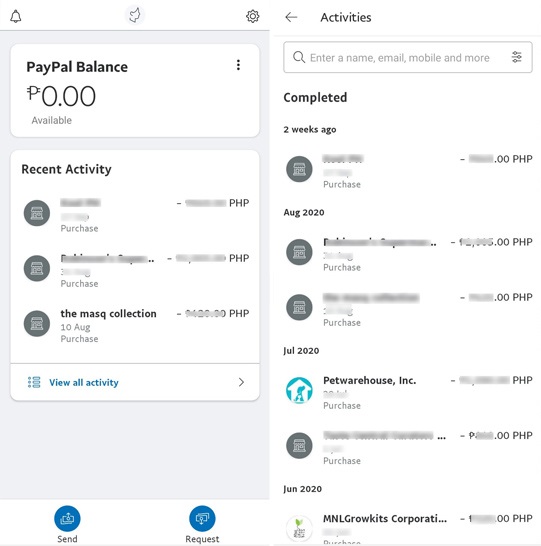

1. PayPal

The lowdown: "I use PayPal to pay monthly bills for the New York Times and Netflix, among others. I also use it when shopping online—it provides an extra layer of safety so I don’t need to input my credit card details into a site I may not have used before. Like most other online payment systems, you get a one-time pin or security code sent via SMS before a transaction goes through, but I feel a certain sense of security when using it because I know I can cancel a payment as long as it hasn’t been claimed, or if it has, I can file a dispute to try to get a refund. It’s also convenient that PayPal sends a monthly email with a receipt for the payments I’ve made—makes it easier to keep track of expenses." - Jo

The verdict: The keyword with PayPal is “straightforward.” The streamlined service’s main use is to help you pay for things online, whether retail websites or monthly bills, and it’s a great alternative to having to input your credit card details whenever you check out online. Plus, you don’t even really need an app to use their services as it essentially does the same thing as the site. There’s the added bonus of being able to file a dispute as well, and even the ability to cancel payments up to 180 days after the transaction (as long as the money has not been claimed). All in all, PayPal tops the list thanks to its ease-of-use, consistency, and reliability.

When you have problems with your cashless payments, what do you do?

[BigImage:{"illustrator":"War Espejo","image":"https://images.summitmedia-digital.com/spotph/images/2020/10/22/virtual-wallets-snag-1603371785.jpg"}]

Everyone has gone through the dreaded "customer service" experience at least once before. You know it: spending hours on end waiting for someone to take your call, or going around in circles with chat bots, endless e-mail threads, and more. So now that your dipping your toes—and your very real and hard-earned money—into these digital finance platforms, we have to ask: "What happens when customer service is basically worthless?" Time for some real talk.

"They are covered by our consumer protection framework," says Joyce Suficiencia, director of the inclusive finance advocacy staff of the Bangko Sentral ng Pilipinas, about digital financial platforms (a.k.a. "E-Money") in an online conference with Summit Media. "We call them the [Bangko Sentral ng Pilipinas (BSP)] financial supervised institutions or the BSFIs. That covers all banks, e-money issuers like PayMaya, GCash, and all these wallet providers—all are covered by our regulations," clarified Suficiencia.

So here's the short answer: The next time customer service isn't getting you anywhere, you can reach out to the BSP with a formal complaint.

And here's the long answer: "When we see a trend in the complaints, we elevate it to the the financial supervision department," continues the director. They look into these trends when they examine the financial entities involved and once their findings come in, so do the penalties for any faults found. "All these complaints that we're getting are basically inputs to supervisory action," says Suficiencia.

While this means the best thing would still be to get a proper response from your virtual wallet's customer service, heading to the BSP will always be an option. And ICYMI, the BSP virtual chatbot went live in August. Called BOB—short for BSP Online Buddy—you can use this channel to send in your complaints.

BOB is available to talk on three platforms:

- BSP Webchat

- SMS – 21582277 (for Globe subscribers only; BOB will also be made available for other network subscribers soon)

- BSP Facebook

"We're trying to beef up and enhance our cybersecurity regulations," added Suficencia. Her department over at the BSP is working on making sure consumers themselves are equipped with enough knowledge to practice digital finance. They have launched digital literacy programs: E-Safe Payments at Home in April; and cybersecurity awareness, with the aim of giving "consumers enough confidence and knowledge to use digital financial services in a safe manner."

According to 2019 BSP data, the number of adults with E-Money accounts rose by 7 percentage points from 2017—and they've yet to account for the growth that occured during quarantine. With the ever-growing shift to digital wallets, it is definitely best to know what you—and your service providers—can and can't do.

[ArticleReco:{"articles":["79881","82475","83778","82082"], "widget":"More from spot"}]

Source: Spot PH

No comments:

Post a Comment